Finding acceptance after your AI "oh f*ck" moment

What to do when AI can do your job better than you

Ten seconds. That's how long it took AI to match what usually takes me an hour. That's when I realized: my job isn't as AI-proof as I thought.

This was my first “oh fuck” moment.

It started innocently - I was playing around with NotebookLM and dropped in a pitch deck, call notes, and YouTube videos to see what would happen. The output was thoughtful and comprehensive. And it took about 10 seconds.

Like many investors (whether they admit it or not), I had cognitive dissonance about AI. It was always someone else’s job at risk - never mine. “What will happen to all the medical scribes?” is a conversation I’ve had many times. Never “what happens to us?”

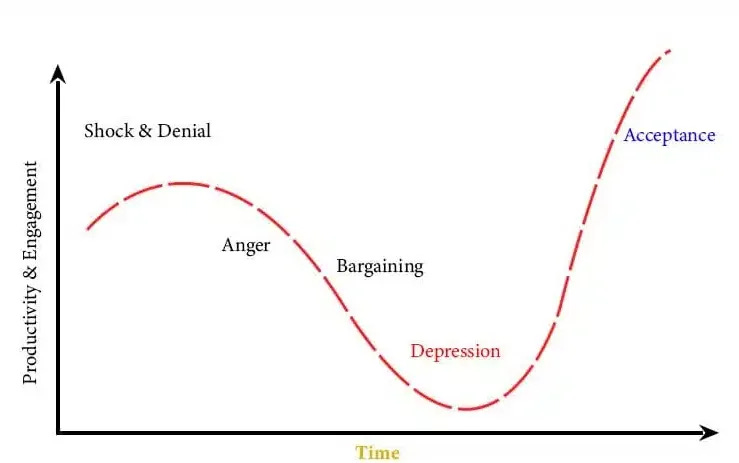

This revelation sent me spiraling through the stages of grief: shock and denial to acceptance. Here's what I learned.

The stages of AI acceptance

Stage 1: Shock & Denial

“Certainly an AI couldn’t do my job better than I could?” I thought to myself. “It must only be good for task X, Y, or Z.”

This is how the initial AI shock tends to go. There’s a single use case that exceeds our preconceived notions of AI’s capabilities. Then, we try to convince ourselves that surely AI is only good at this one narrow task.

Stage 2: Anger & depression

The shock phase has a short shelf life. Once you see that AI can do aspects of your job, you can’t unsee it.

My second big ‘aha’ was when I learned that General Atlantic added an AI named Ada to its five-person investment committee. AI was no longer a diligence tool but an actual “investor.”

And, it’s not hard to see how Ada could outperform a human investor. Compared to a human, Ada...

Never wakes up in a bad mood and brings that energy to work

Isn’t biased towards its own deals

Won’t pass on an investment today just because it made an investment last week

Isn’t scarred by a particular sector because a prior investment went awry

And more (I could and may one day write a whole post on the various biases of investors)

Compared to the average investor, Ada is probably pretty good at making unbiased investment decisions.

This realization made me hit my low point.

Stage 3: Action & Acceptance

After some existential ruminating, the only place left to go was acceptance. I have to accept that AI can and will do parts of my job better (or just as well for less money).

The only rational next step is figuring out how to use AI to my advantage — ASAP.

It’s still evolving but here’s my current AI stack:

ChatGPT: My general-purpose thought partner for brainstorming and quick edits

Perplexity: For market research or quick fact checks

NotebookLM: Go-to for analyzing specific content with clear citations

Granola: Frees me from taking notes on calls

Lex: Spell check on steroids for long-form writing

Spiral: Turns my long-form writing into punchy social media content

And here are some fun ways I’ve been using AI that you might not have thought of:

Ask Granola (or your preferred notetaker) to grade your meeting on a 10-point scale and provide tips to make it a 10.

Prompt the AI to take on multiple personas to debate an idea. A few I like are:

“The Bull” - the person who is vehemently in favor of the idea

“The skeptic” - the person who has reservations about the idea

“The mediator” - the person who can acknowledge both sides and unite the group into a cohesive viewpoint.

Record a 2-minute stream of consciousness summary of any in-person meeting and have ChatGPT/Claude structure it into themes with key follow-ups.

Using these tools isn't something that clicks overnight. It took me dozens of attempts to figure out the right prompts, context, and where AI's insights are most valuable. But the ROI on that learning curve has been huge.

When in doubt: Do first, analyze later

If you’ve gotten this far and are still skeptical, you don’t need to be convinced. You just need to try.

Action beats hesitation, especially when the cost of being wrong is low.

Legendary investor Stanley Druckenmiller has a simple rule: when he spots an opportunity, he takes it. He only then figures out if he’s wrong.1

We’re in such a fast-moving world with all the new communications that if I get an idea and I think it’s attractive and for whatever reason that security price will be higher in a year or two, I generally go ahead and buy it and then tell the analyst to look into it.

AI is the same. If there’s potential upside, start using it now. Worst case, you wasted a little time. Best case, you’re ahead of the curve.

You don’t need to go all in on day one, but you need to start. Play around, experiment, and figure out how to make AI your edge before someone else does.

Once you have your “oh fuck” moment, you won’t look back. In fact, you’ll start to wonder how you ever lived without AI at work.

https://acquirersmultiple.com/2023/05/stanley-druckenmiller-buy-first-analyze-later/